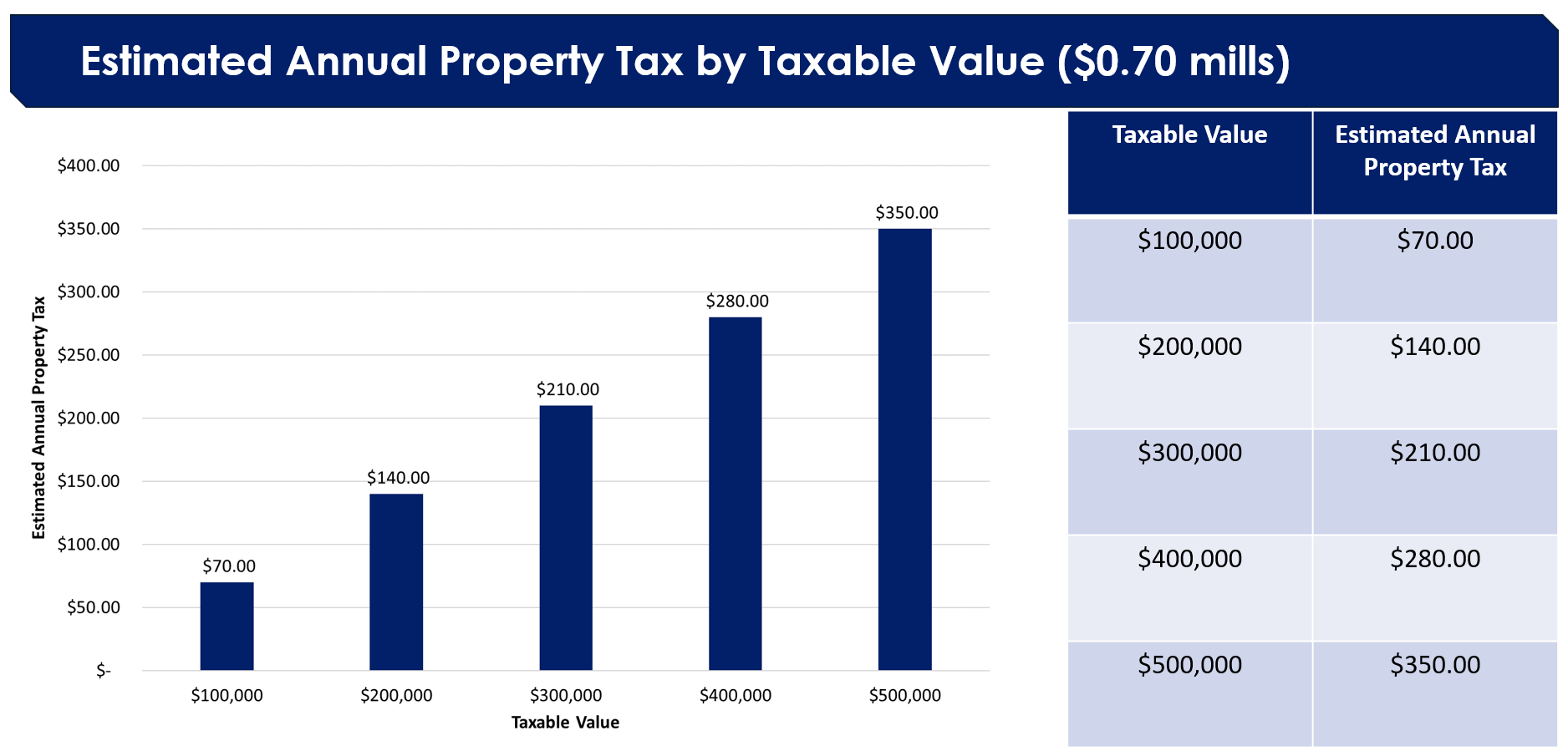

Note: Community Members may be eligible for the Michigan Homestead Property Tax Credit (the "Credit"). The Credit is a method through which some taxpayers can receive a credit for an amount of their property taxes that exceeds a certain percentage of household income. This program establishes categories under which homeowners or renters are eligible. We would recommend that community members consult their tax provider for eligibility and further information.

The above is an ESTIMATE of your net tax impact from the increase in millage for the above proposed sinking fund issue. It is an estimate only and should not be relied upon as tax advice. You should consult your tax advisor to determine the exact impact on your tax computations.